Singapore’s Labour Market Competitiveness Rises to First Place in 2024

Every year, the World Competitiveness Yearbook (WCY), published by the International Institute for Management Development’s (IMD), analyses and ranks the competitiveness of economies, based on hard data from national and international sources, as well as perception-based survey responses from business executives.

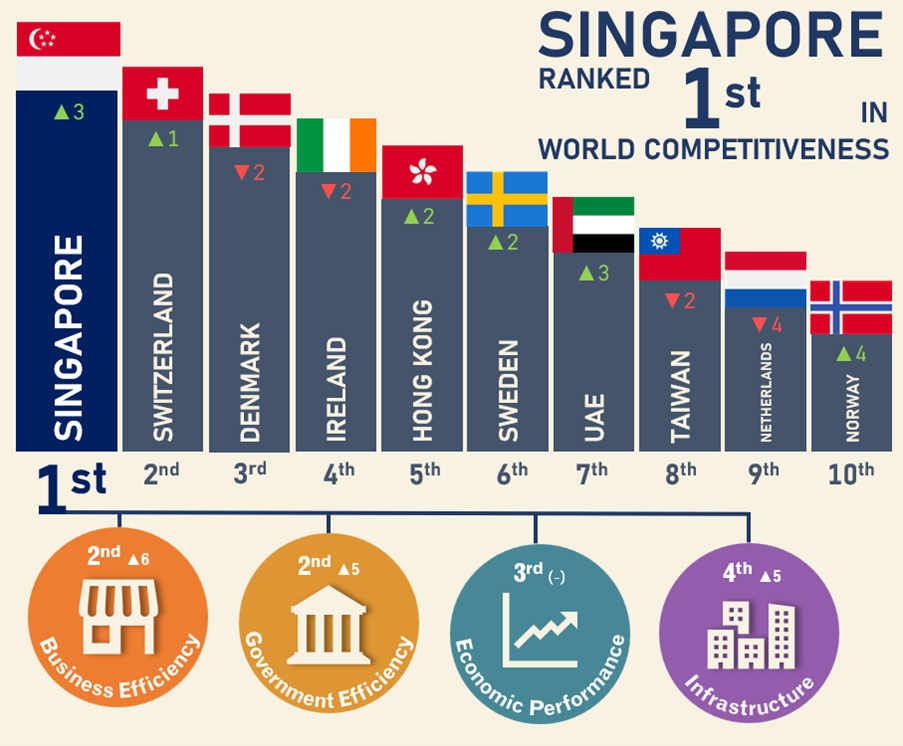

Overall World Performance

In 2024, Singapore ranked 1st out of 67 economies, up three spots from 2023 (4th), overtaking Denmark, Ireland and Switzerland. The strong performance was due to improvements in areas such as Government Efficiency (2nd, up 5 spots), Infrastructure (4th, up 5 spots) and Business Efficiency (2nd, up 6 spots), within which includes labour market competitiveness.

Labour Market Competitiveness

Singapore also placed 1st in terms of Labour Market Competitiveness in 2024, an improvement of 3 places from 2023. Singapore clinched the top spot because of improvements in most Labour Market indicators. Notably, there were improvements in all perception indicators (business sentiments) in WCY 2024.

Strong improvements in business sentiments on workers’ skills, labour relations

Perceptions among business executives were favourable. The ranks showed that they view Singapore as having a strong availability of talent in the labour market in the form of

Competent Senior Managers and

Skilled Labour, while

Brain Drain in the economy was low – Singapore ranked 3rd, ahead of Hong Kong (33rd) and just behind Switzerland (1st), reflecting strong talent retention.

The high ranks for

Employee Training and

Attracting & Retaining Talents as a priority in firms, implementation of

Apprenticeships, and high

Worker Motivation further suggest potential to groom and attract more skilled workers. Notably, Singapore outperformed Hong Kong in all four of these areas, although it was still outpaced by Switzerland, which remained a global leader in talent development.

Singapore also achieved the top rank in

Finance Skills, reflecting an improvement in the perception of financial expertise within its talent pool. This reinforces Singapore’s standing as a leading global financial centre with strong professional capabilities.

Singapore continued to rank well for indicators on levels of globalisation and international experience. The improvements in attractiveness to

Foreign Highly Skilled Personnel alongside

Attracting & Retaining Talents reaffirm recent policy changes to bring in high-quality foreign professionals such as the Complementarity Assessment Framework (COMPASS) and the introduction of the Overseas Networks and Expertise Pass (ONE Pass). However, Switzerland maintained its lead over Singapore, continuing to set the benchmark for international talent competitiveness. These higher ranks reflect the improved quality of talent in Singapore and its positioning as a global business hub.

Singapore’s share of

Females in the Labour Force1 improved substantially, continuing the upward trend observed over the last 10 years. While the average weekly

Working Hours2 in Singapore has decreased, Singapore held its rank, outperforming typical frontier countries on competitiveness such as Hong Kong (15th) and Switzerland (57th). This also signals strong work ethics, relative to peer economies.

Declines in indicators relating to Singapore’s smaller labour force and labour market structure

While we ranked high for

Labour Force Growth and

Participation3, there were declines in ranks for

Labour Force Size and

Long-term Growth, as other economies’ improvements outsized our increases in these measures. Generally, high ranks for size and growth-related indicators are unlikely to be sustained in the future due to Singapore’s smaller population and limited land capacity compared to other economies. Nonetheless, Singapore outperformed Switzerland and Hong Kong in these three key growth-related indicators –

Labour Force Growth and

Participation, and

Long-term Growth.

There was also a decline in our Part-time Employment ranking; although our part-time employment share4 held steady, other economies gained grounds as their part-time employment increased. A high

Part-time Employment share is favourable from the perspective of competitiveness as part-time employment can be more cost-effective for firms. In the longer-term with more flexible work arrangements that include part-time work opportunities, we can tap on a larger pool of workers such as seniors and caregivers who could continue to work on part-time basis, instead of exiting the labour force.

Singapore continued to rank low for cost-related indicators (Compensation Levels and

Remuneration of Management). Economies with low labour cost are ranked higher as it means lower business costs for firms. Singapore, as an advanced economy with higher living standards, cannot compete on a low-cost approach. With a high-skilled workforce, our compensation levels are naturally higher than other economies. Singapore’s rankings for these two indicators can be compared with similar economies with a high-quality workforce, for example, Hong Kong and Switzerland, to reflect a balance between competitiveness and income standards. While Singapore ranks below Hong Kong (34th on Compensation Levels; 57th on Remuneration of Management), it remains more cost competitive than Switzerland (65th on Compensation Levels; 61st on Remuneration of Management).

Singapore’s labour market improved in IMD’s World Competitiveness Ranking 2024 due to favourable sentiments from business leaders.

Singapore tops the ranking on Labour Market Competitiveness, advancing three places on the back of improved perceptions from business leaders on our ability to attract foreign talent and availability of competent senior managers. This reaffirms the importance to maintain a high level of globalisation and international exposure to raise the quality of our workforce, even as our constraints with a small population limit the improvements on labour force and cost-related indicators. Firms should continue long-term planning for their manpower needs and invest in employees’ skills.

____________________

1 The share of females in the resident labour force rose from 45.0% in 2014 to 47.6% in 2024. Source: Comprehensive Labour Force Survey, Manpower Research & Statistics Department, MOM.

2 The average usual hours worked per week by employed residents declined from 41.9 hours in 2023 to 41.6 hours in 2024. Source: Comprehensive Labour Force Survey, Manpower Research & Statistics Department, MOM.

3 Singapore’s labour force participation rate remained higher than many other major cities, at 68.2% in 2024. Source: Comprehensive Labour Force Survey, Manpower Research & Statistics Department, MOM.

4 The part-time employment share among residents was 10.9% in 2024, similar to 2023 (10.6%). Source: Comprehensive Labour Force Survey, Manpower Research & Statistics Department, MOM.