How does Singapore’s Labour Market Fare Globally?

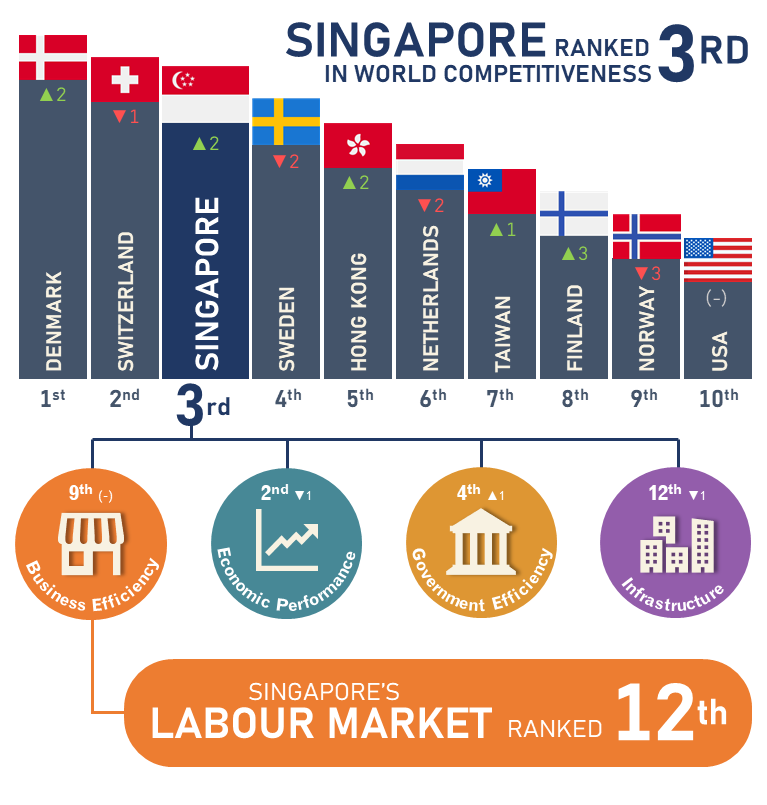

Every year, the Institute for Management Development (IMD)’s World Competitiveness Ranking analyses and ranks the competitiveness of economies.

In 2022, Singapore ranked 3rd out of 63 economies based on four main factors – business efficiency, economic performance, government efficiency, and infrastructure.

Singapore continued to place 9th for

Business Efficiency, within which the Labour Market is a sub-indicator. While the

labour market competitiveness ranking fell eight spots from 4th to 12th, Singapore’s labour market remained attractive to business leaders as our position in most perception-based factors improved.

Improvements in Labour Market Indicators

Businesses thought well of Singapore’s talent pool

We performed well and improved in indicators related to the capabilities of the labour force. Business executives responded favourably to the availability of talent Singapore

(International Experience; Availability of Skilled Labour; Competent Senior Managers) and opportunities for further learning and development (Apprenticeships), as government initiatives were rolled out to support employees in reskilling and upskilling for new jobs.

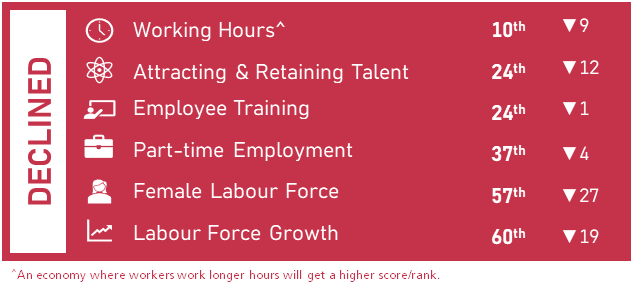

Declines in Labour Market Indicators

As pandemic-related restrictions limited the inflow of foreign workers, declines were observed in areas relating to a more constrained labour force

The significant drop of 12 places in

Attracting & Retaining Talent reflects the perception that this was not as high a priority for enterprises in Singapore compared to other economies. While the economy picked up in 2021, the protracted recovery likely led to companies to prioritise mitigating present issues rather than future plans and capabilities. However, MRSD’s data on Labour Turnover do not suggest difficulty in attracting or retaining talent.1

Singapore’s slower

Labour Force Growth resulting in the low ranking, was due to border restrictions in 2021 which limited the inflow of foreign workers, alongside our smaller population size relative to other economies.

IMD’s ranking favours economies with a greater share of the workforce in

Part-time Employment, which is more cost-efficient for companies. Singapore saw a slight decline in the share of part-time workers in 2020, largely due to the impact of pandemic-related work stoppages on service sectors2. This was coupled with the increased proportion of part-time workers in other economies. In the longer-term, firms are encouraged to provide more flexible work arrangements such as part-time opportunities, so as to tap on more workforce segments such as older workers and caregivers.

While declines in rank are also observed for Working Hours and Female Labour Force, supporting data reveals that these indicators have had positive outcomes.

There was a slight decrease in

Working Hours in Singapore3, whilst significant increases were seen in other economies4. This decline is a step in the right direction as it signals an improvement in job quality and workers’ well-being.

The large decline in

Female Labour Force participation is due to a calculation error. Singapore’s female participation rate has actually been on a steady uptrend in recent years. With the revision, Singapore’s rank would be 25th, up five spots.5

Overall, Singapore performed well in IMD’s World Competitiveness Ranking 2022 despite limitations brought on by the pandemic.

As borders reopened and the economy continued to recover in 2022, perception of Singapore’s talent quality and availability will likely continue to be favourable. However, improvements in indicators related to labour force size are likely to be muted due to Singapore’s smaller population in comparison to the pace of growth in other economies.

View the full infographic

here

____________________

1 The average annual recruitment rate notably increased from 1.6% to 2.1% in from 2020 to 2021. The resignation rate increased slightly from 1.5% to 1.7% from 2020 to 2021, but was similar to levels seen in 2018-2019.

2 These refer to Food & Beverage Services (e.g. waiters, food/drink stall assistants), Retail Trade (e.g. shop sales assistants), Education (e.g. private tutors, extra-curriculum instructors) and Arts, Entertainment & Recreation (e.g. physical fitness instructors), which typically employ more part-time workers.

3 Based on IMD’s computation, in 2019, the average working hours per year was 2,330 hours, or around 45 hours per week (used for computation of the 2021 Ranking). In 2021, the average working hours per year was 2,247 hours, or around 43 hours per week (used for computation of the 2022 Ranking).

4 These include 1st UAE (+337 hours over the year), 2nd Qatar (+231 hours), 4th China (+183 hours) , and 5th Taiwan (+222 hours).

5 Based on the correct share of females in the resident labour force in June 2021 (46.8%), Singapore rank should be 25th, an improvement of five spots from last year and the years before. Singapore’s female labour force ranking was as follows, derived from data in June the year before: 36th in 2018 (45.4%); 32nd in 2019 (45.8%); 28th in 2020 (46.3%); 30th in 2021 (46.3%). IMD has corrected the data online.